Table of Contents

ToggleFTMO or The5ers: Which Prop Firm Is Best?

Choosing the right prop firm can make or break your trading career, and the two giants in the industry are undoubtedly FTMO and The5ers. These firms have risen to prominence for their unique approaches to funding traders, but which one stands out as the best choice? In this article, we’ll dive deep into what makes FTMO and The5ers tick, and help you decide which prop firm is best suited for your trading goals.

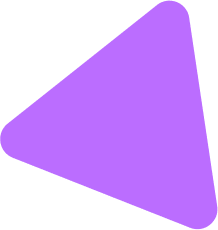

FTMO vs The5ers

What is FTMO?

FTMO is a prop trading firm that has gained a significant following thanks to its well-structured evaluation process and trader-friendly terms. Founded with the mission to provide traders with the opportunity to manage substantial capital, FTMO has built a reputation for being both accessible and professional.

Key Features and Offerings of FTMO

FTMO offers a variety of account sizes, from modest sums to significant capital, making it appealing to a broad range of traders. The firm’s evaluation process, known as the FTMO Challenge, is designed to test a trader’s consistency, discipline, and overall trading skills. Upon passing this challenge, traders are offered the opportunity to manage accounts with capital allocations starting at $100,000.

The Evaluation Process at FTMO

The FTMO evaluation is a two-step process. The first step, the FTMO Challenge, requires traders to meet specific profit targets within a set time frame while adhering to risk management rules. If successful, traders move on to the Verification stage, where they must confirm their trading ability under slightly more lenient conditions. Upon passing both stages, traders become FTMO Traders and can start earning a share of the profits they generate.

FTMO

What is The5ers?

Founded with a similar mission to FTMO , The5ers also aims to empower traders by providing them with significant capital to manage. However, The5ers takes a different approach to funding, focusing on a more long-term and sustainable relationship with its traders.

Key Features and Offerings of The5ers

The5ers is unique in that it offers immediate funding to traders, bypassing the traditional evaluation process that firms like FTMO employ. Traders start with live accounts right away, and while the initial capital may be smaller than what FTMO offers, the growth potential is significant. The5ers is particularly appealing to traders who prefer lower-risk environments, as the firm emphasizes long-term growth over short-term gains.

The Evaluation Process at The5ers

Unlike FTMO, The5ers doesn’t require traders to undergo a preliminary challenge. Instead, traders begin with a funded account and must prove their profitability over time to increase their capital allocation. This model encourages a more sustainable trading approach, as traders are not under pressure to meet specific targets within tight deadlines.

The5ers

Comparison of Evaluation Processes

How FTMO’s Evaluation Works

The FTMO evaluation process is rigorous, focusing on a trader’s ability to meet profit targets while managing risk. This approach ensures that only the most disciplined traders advance to the next stage, making FTMO a highly selective prop firm.

How The5ers’ Evaluation Works

In contrast, The5ers offers a more flexible evaluation process, allowing traders to start with real capital from the get-go. This method is less stressful for traders who prefer to grow their accounts gradually without the pressure of passing a challenge.

Which Firm Has the Easier Evaluation?

While FTMO’s process may be more challenging, it offers higher initial capital, making it ideal for traders confident in their abilities. The5ers, on the other hand, provides a more relaxed entry, making it easier for traders to start, albeit with a lower initial capital.

Trading Conditions: FTMO vs The5ers

Leverage and Risk Management

FTMO is known for its generous leverage options, which can go as high as 1:100, allowing traders to maximize their potential profits. However, this also means higher risk, which FTMO mitigates through strict risk management rules.

The5ers, on the other hand, offers more conservative leverage, typically around 1:6, which aligns with its emphasis on long-term growth and risk aversion. This makes The5ers a safer option for traders who prefer a more controlled trading environment.

Profit-Sharing Models

At FTMO , traders can earn up to 90% of their profits, making it one of the most lucrative profit-sharing models in the industry. The5ers also offers a competitive profit split, but with a focus on steady growth rather than immediate high returns.

Trading Platforms and Tools Available

Both FTMO and The5ers provide access to popular trading platforms like MetaTrader 4 and 5. However, FTMO takes it a step further by offering additional tools and analytics to help traders refine their strategies.

Trading Conditions: FTMO vs The5ers

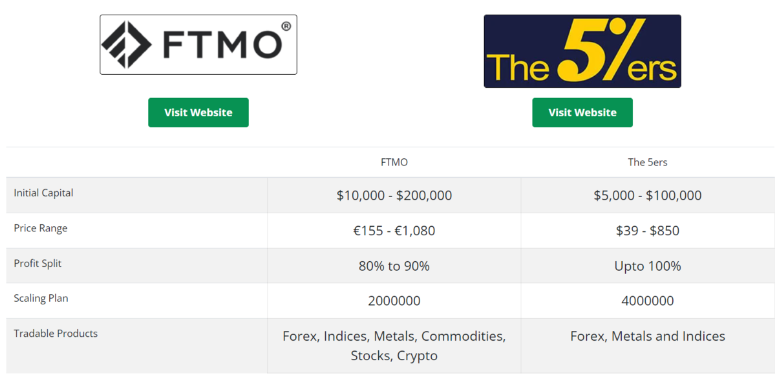

Initial Costs for Joining The5ers

The5ers charges an entry fee as well, typically lower than FTMO’s. However, unlike FTMO, this fee is non-refundable, reflecting the immediate access to a funded account.

Costs The5ers

Hidden Fees and Additional Costs

Both firms are transparent about their costs, with no significant hidden fees. However, traders should be aware of potential costs related to platform usage and data fees.

Success Stories and Testimonials

Successful Traders with FTMO

Many traders have found success with FTMO, with numerous testimonials highlighting the firm’s ability to help traders achieve financial independence. FTMO’s strict evaluation process ensures that only the most capable traders succeed.

Successful Traders with FTMO

Successful Traders with The5ers

The5ers has also cultivated a loyal following, with traders appreciating the firm’s focus on sustainability and long-term growth. Success stories often emphasize the supportive environment and personalized approach.

Successful Traders with The5ers

What Traders Are Saying Online

Online forums and social media platforms are filled with discussions comparing FTMO and The5ers. While both firms have their supporters, the choice often comes down to personal preference and trading style.

Current Promotions and Incentives

Promotions Currently Available at FTMO

FTMO frequently offers discounts on its Challenge fees and has occasional promotions that provide additional capital or reduced fees. These promotions are usually time-limited, so traders need to act quickly to take advantage.

Promotions Currently Available at The5ers

The5ers also runs promotions, often centered around reduced entry fees or enhanced profit splits. Additionally, The5ers may offer bonuses for traders who achieve certain milestones, further incentivizing steady growth.

Which Firm Offers Better Incentives?

While both firms offer attractive promotions, FTMO tends to have more frequent and varied offers, making it a better choice for traders looking to maximize their initial investment.

Pros and Cons of FTMO and The5ers

Advantages of Choosing FTMO

- High profit potential with up to 90% profit splits

- Rigorous evaluation ensures only skilled traders advance

- Extensive educational resources and tools

Disadvantages of Choosing FTMO

- The evaluation process can be stressful and challenging

- Higher upfront costs with the FTMO Challenge fees

Advantages of Choosing The5ers

- Immediate access to funded accounts without an initial challenge

- Emphasis on long-term growth and risk management

- Personalized support and mentoring

Disadvantages of Choosing The5ers

- Lower initial capital compared to FTMO

- More conservative profit-sharing model

The5ers and FTMO

FAQs

1. What are the key differences between FTMO and The5ers?

The main differences lie in their evaluation processes and profit-sharing models. FTMO has a rigorous two-step evaluation, while The5ers offers immediate funding with a focus on long-term growth.

2. Which firm has a more flexible trading environment?

The5ers is generally considered more flexible due to its lower leverage and emphasis on steady growth, while FTMO offers higher leverage with stricter risk management.

3. Can I join both FTMO and The5ers?

Yes, traders can join both firms, allowing them to diversify their trading opportunities and benefit from the unique advantages each firm offers.

4. How does the profit-sharing model work at FTMO and The5ers?

FTMO offers up to 90% profit splits, while The5ers provides a more conservative model that grows over time as traders prove their profitability.

5. What are the typical success rates at FTMO and The5ers?

Success rates vary, but FTMO tends to have a lower success rate due to its challenging evaluation process, while The5ers’ more gradual approach may lead to higher long-term success rates.

This article provides a comprehensive comparison of FTMO and The5ers, helping traders make an informed decision based on their unique needs and trading styles.